The evolution of fintech unicorns such as Wise, Payoneer and Revolut has changed the landscape of banking and finance industry, similar to how Netflix changed the cable and movie industry. These three finance platforms, which recently started to operate in Japan (with the exception to Revolut*), offer digital banking services that are far easier and cheaper than traditional banks.

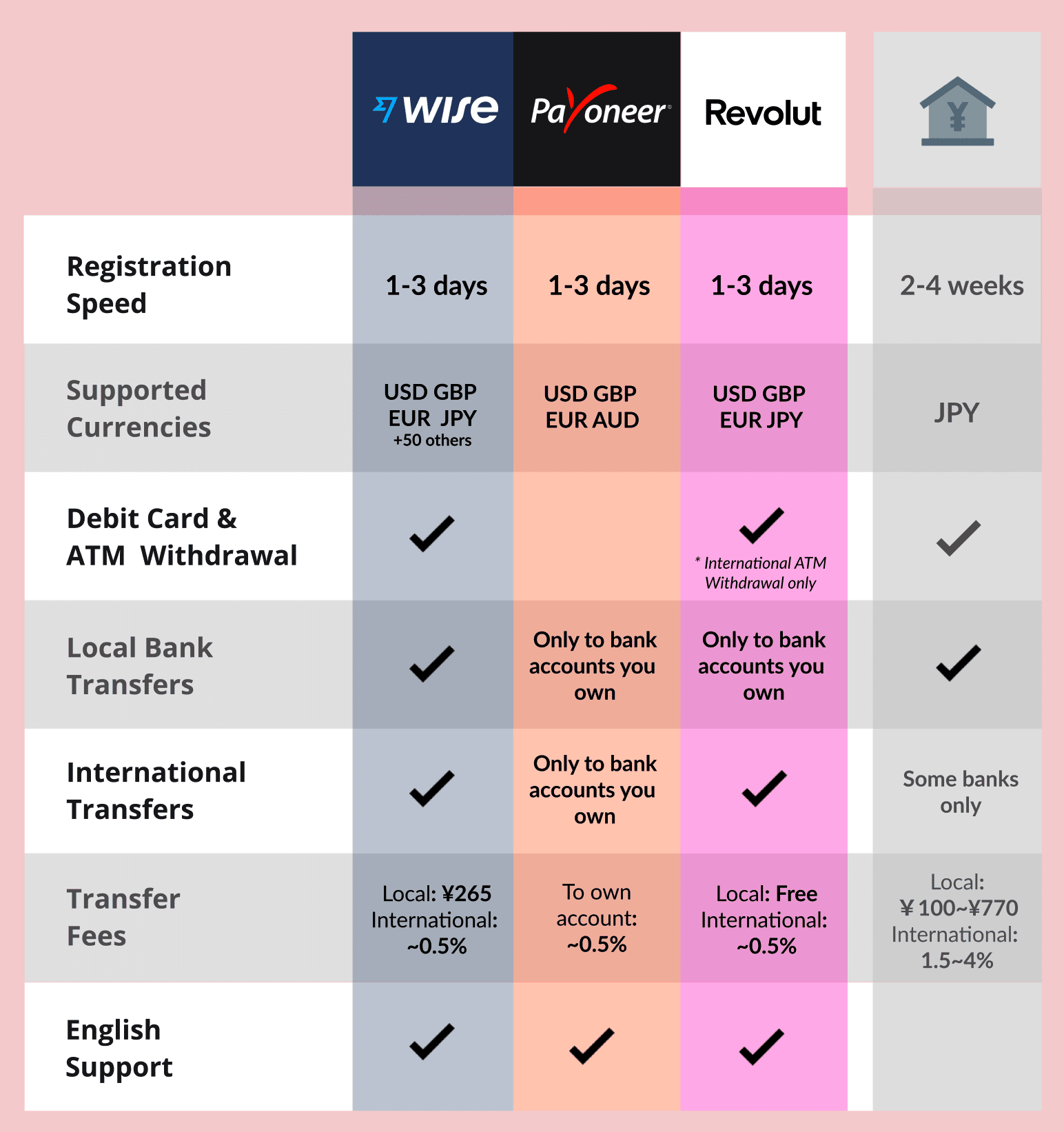

Wise, Payoneer and Revolut have become well known for their fast application process where you can sign up fully online and be able to access banking services immediately through a mobile app or a computer browser, all done without visiting a physical bank. On the other hand, opening an actual account with a Japanese bank normally takes 2-4 weeks and requires you to visit a bank branch or make a phone call. Some foreign companies also end up getting declined by these banks for no particular reason and many of these banks also don’t offer English support.

As a startup company, it would be ideal if you can have access immediately to banking services to start accepting payments from your customers or make daily purchases to your suppliers or service providers. And Wise, Payoneer and Revolut can just be your solution to entering the market much faster and do real business immediately without going through the hassles of working with Japanese banks.

Let’s see what you can do with Wise, Payoneer and Revolut and how they compare with traditional Japanese banks.

Registration Process

With Wise, Payoneer and Revolut you can open an account and get it approved within 1-3 business days, while traditional Japanese banks can take from 2 to 4 weeks. Also, you can open an account fully online with these finance platforms, while Japanese traditional banks will require you to visit a branch or have a phone interview (in Japanese).

Accepting Payments via Bank Transfer

Payoneer, Wise and Revolut all have a “virtual bank account” feature where you are given a bank account that accepts US Dollar, UK Pounds or Euros. This is very useful if you serve the international market as the often used currency is USD. Receiving payments by bank transfer in Japanese Yen is however not provided by these finance platforms. If you need to accept bank transfer payments in Japanese yen, you would need to open a Japanese bank account in this case.

Accepting Online Payments via Credit Card and Paypal

You can accept credit and debit card payments using Payoneer. With Payoneer, you can either use their “request a payment” feature and your customers can pay you via debit card. If you need to run an e-commerce site, you would need a payment processor to integrate payments in your site. 2checkout is payment processor you can use for this purpose and connects directly to Payoneer. As of this moment, accepting credit card payments with Wise and Revolut is not possible.

Alternatively, you can use Paypal and you customer can pay you using their credit card or using their paypal funds. You can link your USD virtual bank in Payoneer, Revolut or Wise with paypal to receive payouts.

Debit Card and Withdrawal via ATM

Wise and Revolut comes with a debit card so you can use the debit card to make purchases and withdraw via an ATM. There are transaction fees when doing debit card payments and ATM withdrawal:

Wise Card Use Fees: https://wise.com/jp/pricing/card-spending

Revolut Card Use Fees: https://www.revolut.com/en-JP/legal/fees

Note: For Revolut, domestic ATM withdrawal is currently no available. You can still use the debit card for making online/POS purchases.

Payoneer currently doesn’t provide a debit card for Japanese companies. To withdraw your funds from Payoneer, you need to do a bank transfer to your personal account (or another account) and withdraw the money from that second account.

Local Bank and International Transfers

Wise and Revolut supports both local and international bank transfers. There is a service charge for making transfers as shown in the links below. Transfer fees are generally cheaper than Japanese traditional banks (see links below).

Wise Transfer Fees: https://wise.com/jp/pricing/send-money

Revolut Transfer Fees: https://www.revolut.com/business/help/making-payments/…

For Payoneer, Japanese accounts currently do not have the capability to transfer funds to a bank you do not own. You can only transfer funds to bank accounts you own (personal or business).

Multicurrency Support and conversion fees

Wise and Revolut supports JPY, USD, GBP and Euro while Payoneer supports USD, GBP and AUD. Foreign exchange fees with Wise, Payoneer and Revolut are competitive and are generally cheaper than traditional Japanese banks.

Customer Support

Payoneer, Wise and Revolut can be contacted by live chat and is the fastest way to reach them. All these finance platforms uses English when communicating with you. Wise also provides email support while Payoneer provides both email and phone support.

In contrast, most traditional Japanese banks only provides Japanese support and can only be reached through phone or by visiting a branch office.

So, can Wise, Payoneer and Revolut replace Japanese Banks?

As Wise, Payoneer and Revolut grow and compete with each other, they have the capability to ultimately replace traditional banks in the future. As of now, there are still limitations with these finance platforms and you will still need a Japanese bank as your business develops. These finance platforms will surely help you in terms of entering the market faster but you cannot use these platforms for accepting offline payments, employee payroll, storing large amount of money or transacting with Japanese institutions that require the “auto-debit” function.

In fact, you can maximize your access to financial or banking services when having both a Japanese bank and one or more of these finance platforms. It is good to use Wise, Payoneer and Revolut for digital payments and international transactions as they offer cheaper transaction fees and a Japanese bank for local transactions, employee payments and transacting with Japanese institutions.

*For Revolut – opening a business account is still not available in Japan and you can sign up to receive a notification once it becomes available.

How do I register with Wise, Payoneer and Revolut?

Below are the links to register to Wise, Payoneer and Revolut.

Get Started with Wise:

https://wise.com/register/?country=JP

Get Started with Payoneer:

https://www.payoneer.com/accounts/

Be notified when Revolut Business launches in Japan:

https://business.revolut.com/

Other innovative Japanese banks

Fully-online banks has also evolved in Japan. You will still need to go through some Japanese sign up forms and wait for at least two weeks for the verification process to finish. However, these bank are far easier and you have a better chance of being approved compared to other traditional Japanese banks.

Check this related article to know more about these banks: Picking a Japanese Corporate Bank Account Amidst the Covid-19 Pandemic